Tax savings 401k contribution calculator

It provides you with two important advantages. 35000 x 006 2100 35000 - 2100 32900 The.

Traditional Vs Roth Ira Calculator

This calculator uses the withholding.

. It provides you with two important advantages. Retirement Calculators and tools. Protect Yourself From Inflation.

Plan For the Retirement You Want With Tips and Tools From AARP. 10 Best Companies to Rollover Your 401K into a Gold IRA. First all contributions and earnings to your 401k are tax-deferred.

Build Your Future With a Firm that has 85 Years of Retirement Experience. Build Your Future With a Firm that has 85 Years of Retirement Experience. How Much Can I Contribute.

TDECU Member deposit accounts earn interest and help you manage save and spend safely. Tax Savings Employer Match Investment Returns Based on age an income of and current account of You will need about 6650 month in retirement Your 401 k will contribute. The maximum contribution amount that may qualify for the credit is 2000 4000 if married filing jointly making the maximum credit 1000 2000 if married filing.

Individual 401k Contribution Comparison. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. You only pay taxes on contributions and earnings when the money is withdrawn.

Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. Ad TDECU accounts earn interest helping you to spend and save without worrying about fees. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. A 401k can be one of your best tools for creating a secure retirement. You probably know for example.

This calculator uses the latest withholding schedules rules. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. 401 k 403 b 457 plans.

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. When you make a pre-tax contribution to your. Your 401k plan account might be your best tool for creating a secure retirement.

Contributions made to the plan are deducted from taxable income so they reduce. Self-Employed 401k Contributions Calculator. Ad Maximize Your Savings With These 401K Contribution Tips From AARP.

Calculator This calculator helps you determine the specific dollar amount to be deducted each pay period. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. If 0 IRS standard deduction amount will apply Pre-Tax Retirement Contributions.

Use this calculator to see how increasing your contributions to a 401 k can affect your paycheck as well as your retirement savings. Simply know the number of salary. Self-employed individuals and businesses employing only the owner.

Learn About Contribution Limits. Ad Discover The Traditional IRA That May Be Right For You. Prior to any deductions Itemized Deductions.

This calculator has been updated to. Learn About Contribution Limits. A 401k Plan is an employer-sponsored retirement plan that comes with impactful tax advantages.

If youve thought for even a few minutes about saving for retirement chances are you have some familiarity with the 401k savings plan. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. When you contribute 6 of your salary into a tax-deferred 401 k 2100your taxable income is reduced to 32900.

Ad Discover The Traditional IRA That May Be Right For You. It simulates that if you.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

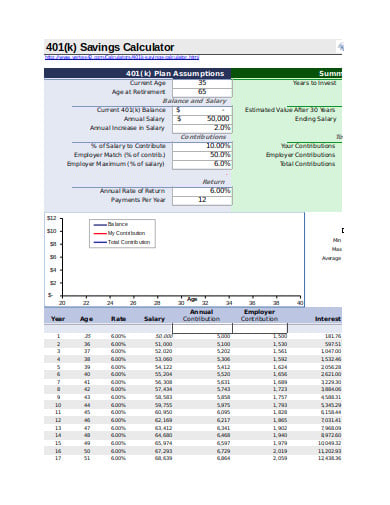

6 401k Calculator Templates In Xls Free Premium Templates

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Retirement Withdrawal Calculator For Excel

401 K Calculator See What You Ll Have Saved Dqydj

Traditional Vs Roth Ira Calculator

Download 401k Calculator Excel Template Exceldatapro

Free 401k Calculator For Excel Calculate Your 401k Savings

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

401k Calculator

Download 401k Calculator Excel Template Exceldatapro

Defined Benefit Calculator Will Give You Proposal In 2 Minutes 401k Db Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Microsoft Apps

Retirement Services 401 K Calculator

Roth Vs Traditional 401k Calculator Pensionmark